Solving some of life’s taxing issues…and helping UIW students

A great option that allows supporters to donate to the university while providing financial support for themselves and loved ones is a Charitable Remainder Trust (CRT).

What is a CRT?

A CRT is an irrevocable trust that provides income for the donor for a fixed number of years or for the life of the donor. The remaining funds go to the donor’s designated charitable organizations, such as UIW, for purposes designated by the donor.

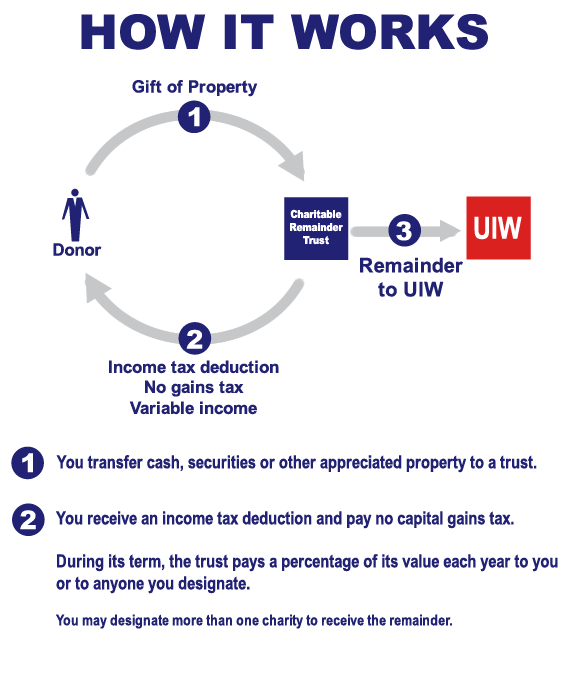

How a CRT Works

For example, say a UIW alumna wants to donate to the university, but needs additional income for retirement. She owns real estate that has tripled in value, but it does not generate income. She decides to create a CRT and fund it with the appreciated real estate. When the land is transferred to the CRT, she receives an immediate charitable deduction. The CRT sells the land tax free (avoiding capital gains tax), and creates a diversified stock/bond portfolio that will generate income for the remainder of her lifetime. CRT funds remaining after her death, would be transferred to UIW. (see illustration)

For example, say a UIW alumna wants to donate to the university, but needs additional income for retirement. She owns real estate that has tripled in value, but it does not generate income. She decides to create a CRT and fund it with the appreciated real estate. When the land is transferred to the CRT, she receives an immediate charitable deduction. The CRT sells the land tax free (avoiding capital gains tax), and creates a diversified stock/bond portfolio that will generate income for the remainder of her lifetime. CRT funds remaining after her death, would be transferred to UIW. (see illustration)

Funding a CRT

A CRT can be established during your life or through your will. It can be funded with any type of asset: cash, stocks, real estate, mineral interest, patents, copyrights or life insurance proceeds. Funding a CRT with highly appreciated assets can give you the biggest return due to tax benefits.

Creditors can’t reach assets in a CRT, and the value of the property is excluded from the donor’s taxable estate, thus the property avoids probate.

To find out more, contact UIW Planned Giving Director Diane Echavarria at (210) 829-6071 or [email protected].

By Pam Parish, CFP®, group executive vice president at Broadway Bank. She is a member of UIW’s Planned Giving Council, which advises the university and serves as a resource for alumni and friends. Visit www.uiw.edu/giving/plannedgivcouncil.html.

By Pam Parish, CFP®, group executive vice president at Broadway Bank. She is a member of UIW’s Planned Giving Council, which advises the university and serves as a resource for alumni and friends. Visit www.uiw.edu/giving/plannedgivcouncil.html.